Introduction:

Regulation B, an integral component of the Equal Credit Opportunity Act (ECOA), plays a crucial role in ensuring fair lending practices in the United States. Enacted under 15 U.S.C. 1601 et seq., Regulation B establishes guidelines for lenders, prohibiting discrimination against credit applicants, and providing a framework for evaluating credit information. This blog delves into the key provisions of Regulation B, shedding light on its implications for both lenders and applicants.

Prohibiting Discrimination:

Regulation B prohibits lenders from discriminating against credit applicants based on factors such as race, sex, or marital status. The primary objective is to ensure that the credit evaluation process is fair and unbiased. This regulation is outlined in 12 C.F.R. Parts 202.

Restrictions on Credit History Consideration:

Lenders are generally allowed to impose restrictions on the types of credit history and credit references they consider during the creditworthiness assessment. These restrictions, however, must be applied uniformly to all applicants, without any regard to prohibited bases. This provision, found in 12 C.F.R. Parts 202, Supp. I, 6(b)(6), aims to maintain consistency and fairness in the lending process.

Applicant-Requested Consideration of Additional Information:

In an effort to ensure a comprehensive evaluation of creditworthiness, Regulation B requires creditors to consider additional information at the applicant’s request. This becomes relevant when an applicant presents information that is not typically considered but may provide a more accurate reflection of their creditworthiness. The specific guideline can be found in 12 C.F.R. §202.6(b)(6)(ii).

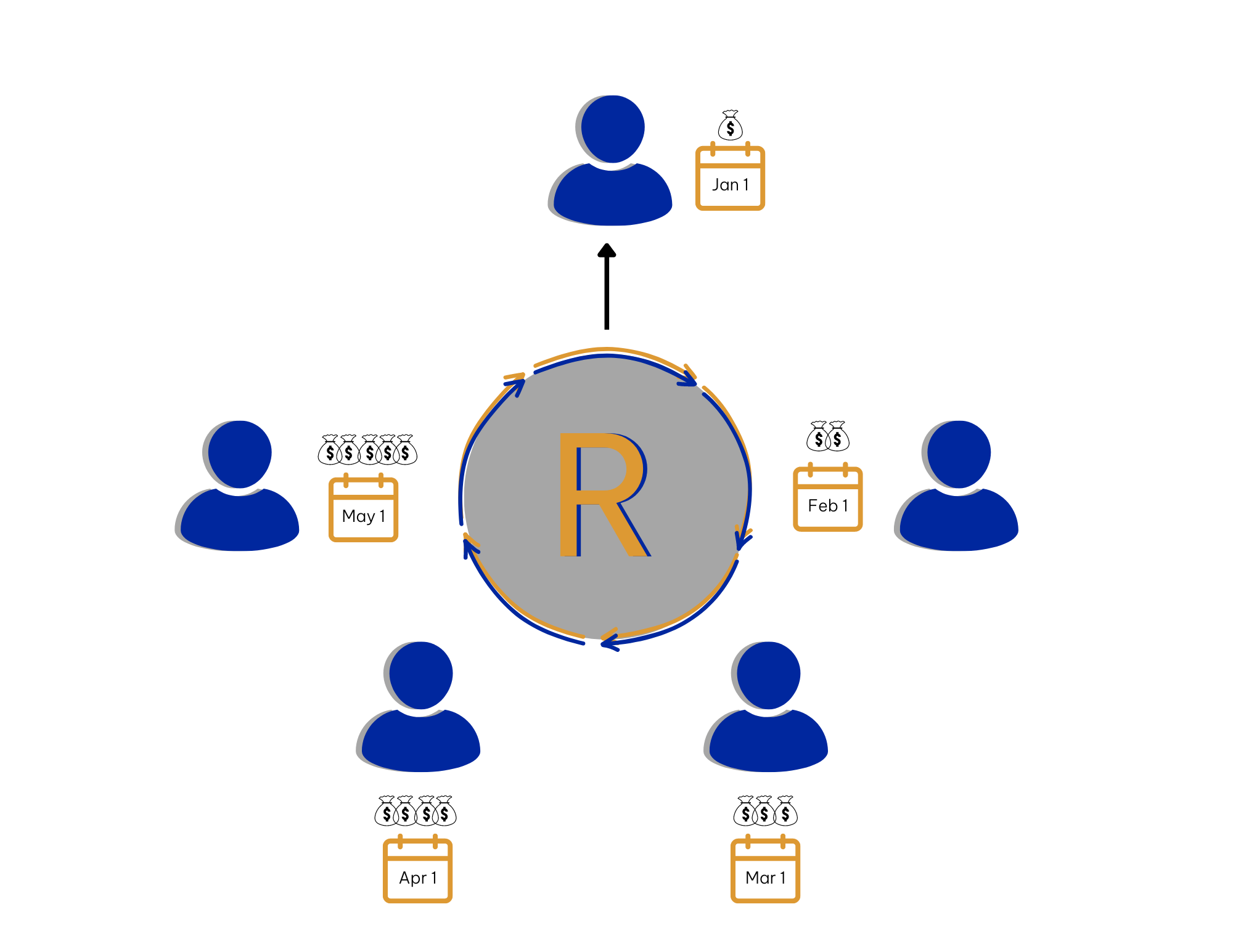

Considering Non-Bureau Credit Information:

The Official Staff Commentary to Regulation B clarifies that creditors, upon an applicant’s request, must consider credit information not reported through a credit bureau. This consideration is mandated when the information relates to the same types of credit references and history that the creditor would typically consider if reported through a credit bureau. This ensures that a more holistic view of the applicant’s creditworthiness is taken into account, as stated in 12 C.F.R. Parts 202, Supp. I, 6(b)(6).

Practical Example:

For instance, if a creditor relies on credit reports from a major credit reporting agency, the creditor is obligated, upon the applicant’s request, to consider any other payment information meeting the criteria specified in 12 C.F.R. §202.6(b)(6)(ii).

How Consulytica Helps:

Consulytica takes an innovative approach to ensure compliance with Regulation B, an integral part of the Equal Credit Opportunity Act (ECOA), which safeguards fair lending practices in the United States. Our platform aligns with Regulation B’s core objective of prohibiting discrimination against credit applicants based on factors like race, sex, or marital status. We empower lenders by providing a comprehensive credit evaluation process that considers additional information at the applicant’s request, ensuring a holistic view of creditworthiness. Consulytica also facilitates the consideration of non-bureau credit information, enhancing the transparency and fairness of the lending process. In embracing the principles of Regulation B, we contribute to a financial landscape that is unbiased, transparent, and equitable for all stakeholders.